Britons Underestimating Costs Of Significant Events in Life

Research carried out by one of Britain’s largest banks has revealed that we are guilty of not budgeting enough for the six key checkpoints in our lives: buying our first car, putting a deposit down on a house, going to university, getting married, having children and then sending those children to university.

The survey found that there is a massive £124,000 between what people are expecting to pay (£190,156) and the reality (£313,859) of how much these key milestones are going to cost.

The survey of over 1,000 UK adults found that people:

- Underestimated the cost of their first car by £2,500

- Thought that the deposit on their first house would be around £29,000, not £38,000

- Estimated their student debt would be £9,000 lower than the true amount of £20,000.

- Guessed that the price of a wedding would be around £8,500 rather than £20,000

- Underestimated the cost of raising their first child, as most believed that it would cost them around £86,000 – over £116,000 lower than the real cost of over £200,000.

The research also showed that more Britons intend to cover the costs for life’s big events using their savings. Now that interest is so high and the cost of living keeps going up every day, it just is not common for people to have savings that are easily accessible. Many of us in the UK will inevitably have to postpone some of these key milestones like buying a first house or getting married because they just aren’t affordable.

Although you wouldn’t be able to cover the costs of the larger amounts of money like for a wedding or your first home, taking out a payday loan via instant payday loans direct lenders could help ease the strain and to tide you over until you manage to meet these important big events in our lives. Check out text loans lenders UK if you need a little extra cash until your next payday!

Read MoreGet The Loan You Need Even With Bad Credit

There comes a point in life where you are going to need money that will probably require obtaining a loan. However if you have made some financial mistakes you might find it a little more difficult to obtain that loan you need. The good news is that there may be a lender that will lend you the money you need through a secured personal loan.

Types Of Personal Loans

When you are shopping around for a loan you will find that there are two types of personal loans. These are known as unsecured personal loans and secured personal loans. Depending on what your credit score is you have the capability to qualify for one or the other however if your credit history is poor you will likely need to apply for a secured personal loan at okay credit loan.

What Is A Secured Loan

A secured loan is the best type of loan for someone who has bad credit and not able to obtain an unsecured loan. What this means is that you will need to have some type of personal property that holds a value to it that you will pledge as collateral. This is the collateral that will be used to secure the loan for the lender.

There are many different types of collateral that can be used. The most common types are vehicles that are already owned by the borrower and the borrower holds a clear title to it as well as a home. But these are not the only items that are accepted as collateral for a secured personal loan. Other items can be collectable items as well as jewelry or many other things. The decision on what to except for the collateral is completely up to the lender.

There are many different types of collateral that can be used. The most common types are vehicles that are already owned by the borrower and the borrower holds a clear title to it as well as a home. But these are not the only items that are accepted as collateral for a secured personal loan. Other items can be collectable items as well as jewelry or many other things. The decision on what to except for the collateral is completely up to the lender.

Marketing Analytics is the Core of E-Business Development

Marketing analytics is the capacity and enhance of your marketing actions. In preference of concentrate only on your e-business performance like with web analytics, you need to spotlight on how your advertising efforts are performing, and correct them consequently. Marketing analytics goes further than basic pointers and inclines on additional tools, offsite actions, and even some offline labor if you want to be as good as you can. It takes a full approach to the capacity of your marketing.

Marketing analytics will assists to your e-business so that you can see how the whole thing plays with every other piece, and decide what the best strategy to put in stirring ahead is. They helps you to arrange things in a new order of importance how you use your time, how you construct out your team, and the capital you spend in feeds and efforts are serious steps to accomplishing marketing team achievement.

Like a lot of innovative approaches to analytics, there is an education arc. That way there will go to be a number of truthful clarification and defining. It is crucial to give you all the parts of marketing analytics so that you can better understand importance of using it for benefit of your e-business.

How to Monetize Your E-business

E-business website development is definitely a key task in motivating customers to your. Buyers are looking for a modified and attractive online shopping experience. We are going to show you some of neat yet very easy tricks that help e-businesses to monetize their website development.

Make it Work!

It is very important to check that everything is working properly before you launch your website. What is definitely the key thing is that your presentation works on all browsers. So make sure that your website is working properly on Chrome, Internet Explorer, Firefox, or even Opera browser. If your website is working perfectly then it’s more likely to get better traffic and it will means more costumers for you to e-business.

It is very important to check that everything is working properly before you launch your website. What is definitely the key thing is that your presentation works on all browsers. So make sure that your website is working properly on Chrome, Internet Explorer, Firefox, or even Opera browser. If your website is working perfectly then it’s more likely to get better traffic and it will means more costumers for you to e-business.

Keep calm and reclaim your mis-sold PPI payments

As a credit consumer for some time now, you probably have learnt of people making PPI claims upon discovering that the policy was mis-sold to them. Some have used companies like www.bestppiclaims.org while others have done their own claim. The money they were able to get back from the banks that sold them PPI was beyond belief for some. The high payouts were well deserved by those who felt cheated and were angered by the ways the policy was wrongly applied alongside credit agreements – credit cards, store cards, loans, and mortgages.

At one point in the past ten years, Payment Protection Insurance has become the most profitable source of sales for a lot of financial institutions. It was an ideal solution for people who need a policy to help them keep up with their repayments should they suddenly become unable to due to sickness, redundancy, or accident.

The fiasco started when a lot of credit consumers were unaware that they were being signed up to the policy, and in some cases it was being offered as a condition for the approval of credit applications. Financial institutions have calculated a huge amount of profit from excessive fees without being noticed by their customers, so a lot them devised schemes to sell PPI in highly irregular manners.

When the mis-selling was discovered, the High Court ruled that the money paid to PPI should be returned following an account review, leading people to make PPI claims at the earliest possible time. A great number of these people have never wanted or needed the cover provided by the policy and some were even signed up to it even though they were ineligible to claim if the situation called for it. There were also reported some sellers even forged their customers’ signatures on PPI contracts.

These mis-selling situations could infuriate anyone, including you. However, if you let your anger subside and start thinking about it, you could actually begin making a claim for yourself. You could either hire the services of a PPI claims company, or make the claim on your own. If you opt for the second, here’s a trouble-free guide for you to follow.

Before you even begin running to your bank and make a claim, you need to know how important evidence is to this kind of dispute. You wouldn’t want your case dismissed and be accused if fraudulent-claiming so gather as much proof that it was mis-sold to you. Look though your account-related documents for reference to Payment Protection Insurance. It should be indicated in your statements and credit agreement forms. A policy certificate should also have been sent to you after the sign-up.

When you’ve got your evidence together, write to you bank about the mis-selling and state your intent to claim your money back. Attach the paperwork you gathered for them to review together with your account information in their database. An investigation on PPI claims usually runs for 6 to 8 weeks, given sufficient evidence and the least amount of complications.

When the bank has finished reviewing you case, they’ll let you know about it. If successful, you’ll have to discuss with them how you are going to be paid. If you have an outstanding debt, the reimbursement will have to cover its repayment. If none, they’ll issue a cheque with the full amount paid to PPI and the interest it rolled over time.

In cases where the bank’s decision was unsatisfactory or they failed to initiate contact after the review, you can lodge a complaint against them at the Financial Ombudsman Service. The FOS then takes over the review of your PPI claim and decides on it after they have made further enquiries with the bank regarding their actions to resolve the dispute.

This whole process can take weeks but the prize at the end could be all worth it, especially if you know you’ve got a solid mis-selling case against your bank. By reasonably making this PPI claim, you’d be able to save yourself from an impending financial trouble, and you may still be able to afford a bit of luxury with the extra cash.

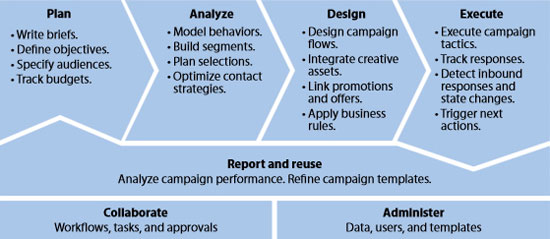

Read MoreCross-Channel Marketing

There are a lot of people who often mixed up multi-channel and cross-channel marketing. The main difference between these two types of marketing approach is that multi-channel marketing create and launch campaigns across multiple channels separately, while the cross-channel marketing use a single marketing channel, such as direct mail or internet, to support or promote another channel, such as retailing. Important thing is that customers don’t think about channels form that they are absorbing information, they just want convenience.

New media platforms have, and will continue to, change the way marketers manage campaigns across different channels. In today’s world ordinary customers move across wide range of channels, and they expect timely and coordinated experiences from their favourite brands, but company that produced those brands where no near ready to deal with such a unique interaction with customers trough individual channels, and the messages wasn’t delivered at time. It’s very confusing to the customers in one side, and very expensive for the brands on the other. So, the cross-channel marketing creates ability for brands to get closer with customers, using whole spectrum of channels to reach and be in contact with costumers.

According to the recent survey, many companies still don’t know how to work within cross-channel marketing. They are pretty solid when it comes to TV, mobile, print, social and any other type of advertising in particularly, but is a big challenge for them to create a cross-channel marketing that will embrace every single one of them into unique strategy. Almost 80% companies believe that their recent marketing efforts fall short because of not enough analytics that provide cross-channel marketing, while there’s a half majority of companies who thinks that’s is very important if they want to adapt in new ways of how customers absorbing information.

Read MoreChanges Introduced by e-business

It is a concept that will transform many industries into virtual network of buyers and sellers. Successful organizations implement e-commerce to integrate business processes and improve work operations within the organization. As a result they get better business results, better internal organizational structure and effective management. In order to be successful in these changes, organizations must adapt and learn new approaches to strategy, planning and business management. The changes will accelerate in the future, and new technological developments in the digital economy will abound creating new fundamental approach to e-business of government, society and economy with social and political implications.

Electronic commerce and the possibility of online billing and payment, electronic banking and money transfer from abroad via the Internet, mobile banking and business software are a part of e-business as a whole, which is correlated with the economic development of the country at the national and socio-organizational level .

In countries where the Internet is expensive, slow or unavailable, the community is at the margins of contemporary world events and trends of development. In these areas the organizations and companies have limited resources and can not react in time to market demands.

Read More